Your weekly perch for all things real estate.

The White House’s executive order was supposed to put institutional investors in a housing timeout, but build-to-rent developers just found a VIP side door. Meanwhile, new listings are finally ticking up, San Francisco is coming for New York's rent crown, and Americans keep fleeing California like it owes them money.

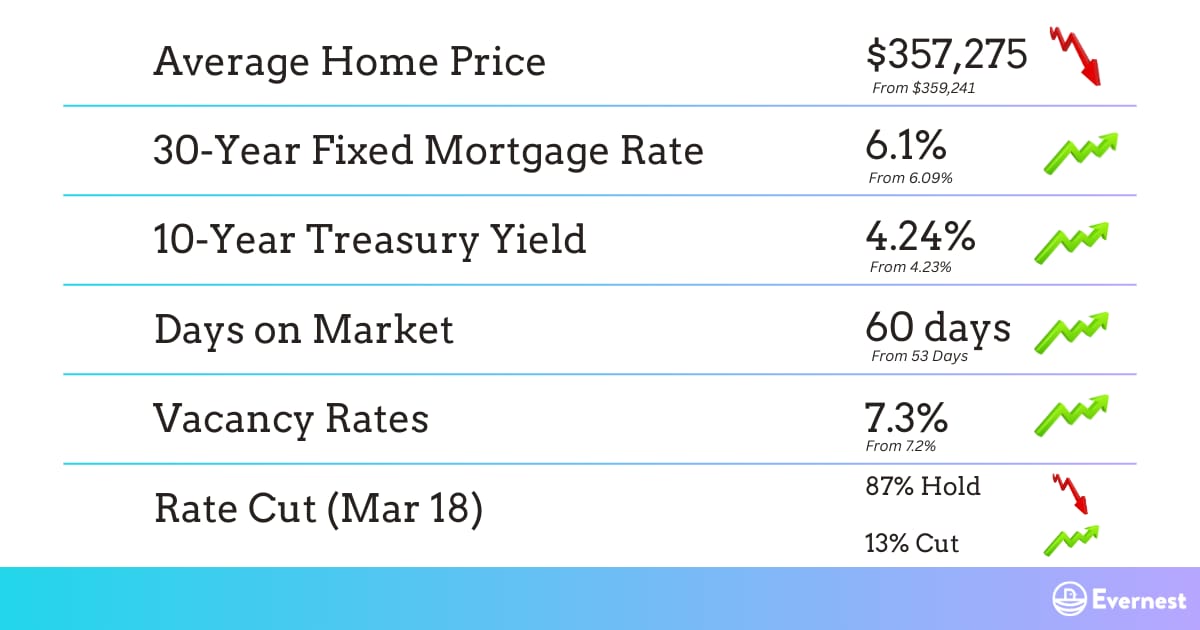

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

LOOPHOLE SWEET LOOPHOLE

Story: The White House’s executive order cracking down on institutional investors buying single-family homes came with a carve-out: build-to-rent developers who are actually adding homes to the market are exempt. The distinction makes sense: rather than penalizing investors who are part of the housing solution, the order targets those competing with everyday homebuyers for existing inventory. And the BTR sector has earned its seat at the table. Since 2012, developers have built over 321,000 build-to-rent homes in the U.S., with nearly 75% constructed in just the last five years. Major homebuilders are increasingly partnering with institutional capital to deliver entire purpose-built rental communities, creating jobs, boosting local tax bases, and putting brand-new roofs over renters' heads.

So What? The exemption validates what the build-to-rent industry has been saying for years. For investors, the math just got friendlier, where you control the dirt and the product. BTR offers operational scale, tighter expense ratios, and lease-up velocity in suburban nodes where for-sale affordability still bites. It also sidesteps the political heat of competing with entry-level buyers for resale stock. Expect lower acquisition friction, better design standardization, and stickier NOI, where schools, commute times, and amenities align with the “rent the lifestyle” thesis.

What’s Next? While some details around land sellers and homebuilder pipelines still need clarification, the signal from Washington is unmistakably positive for BTR operators. Congress may weigh in further, but the momentum is clearly on the sector's side. Single-family rental demand remains elevated, suburban migration trends are holding strong, and the regulatory tailwind gives developers and investors renewed confidence to break ground. Expect capital to flow even faster into build-to-rent as the rules solidify. This exemption isn't just a loophole; it's a blueprint for how institutional investment and housing policy can actually work together.

Source: WSJ

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: New listings rose ~1% year-over-year for the first time in two months as lower mortgage rates (6.09%) and declining monthly housing payments coax sellers and buyers off the sidelines, though homes are now taking 63 days to go under contract, the longest in six years. 🪺 More

2️⃣ Rents: National median one-bedroom rent slipped 0.1% to $1,503, but San Francisco is stealing the spotlight with a jaw-dropping 16.1% annual jump, now just $130 behind New York City on two-bedroom pricing. 🪺 More

3️⃣ Mortgages: The 30-year fixed rate ticked up 1 basis point to 6.1% as the Fed held steady, consumer confidence cratered to a decade-plus low, and geopolitical tensions keep Treasury yields (and your rate-lock anxiety) nice and volatile for the foreseeable future. 🪺 More

4️⃣ Interesting Trends: Fresh Census data shows North Carolina (+84,064), Texas (+67,299), and South Carolina (+66,622) led net domestic migration gains, while California (-229,077) and New York (-137,586) continue hemorrhaging residents. 🪺 More

5️⃣ Policy Changes: Trump nominated former Fed governor Kevin Warsh (known as a consensus builder) to replace Jerome Powell as Fed Chair, but confirmation faces headwinds from a Senate blockade tied to a DOJ inquiry into Powell, and economists are side-eyeing Warsh's pivot from opposing rate cuts during the Great Recession to embracing them now. 🪺 More

INVESTOR HIGHLIGHTS:

🎙️ Podcast Highlight: What Renovations Actually Increase Rent? (And What's a Waste of Money)

📰 Article Highlight: How and Where to Invest in Birmingham, Alabama

💸 Off-Market Deal: Turnkey 3BR in Midfield | Long-Term Tenant in Place