Your weekly perch for all things real estate.

A wave of unionization is sweeping through affordable housing complexes, targeting none other than large private equity firms. And not just one building at a time, but an entire portfolio of properties. With corporate landlords now facing a tenant uprising, it’s a moment of reckoning that could change the game.

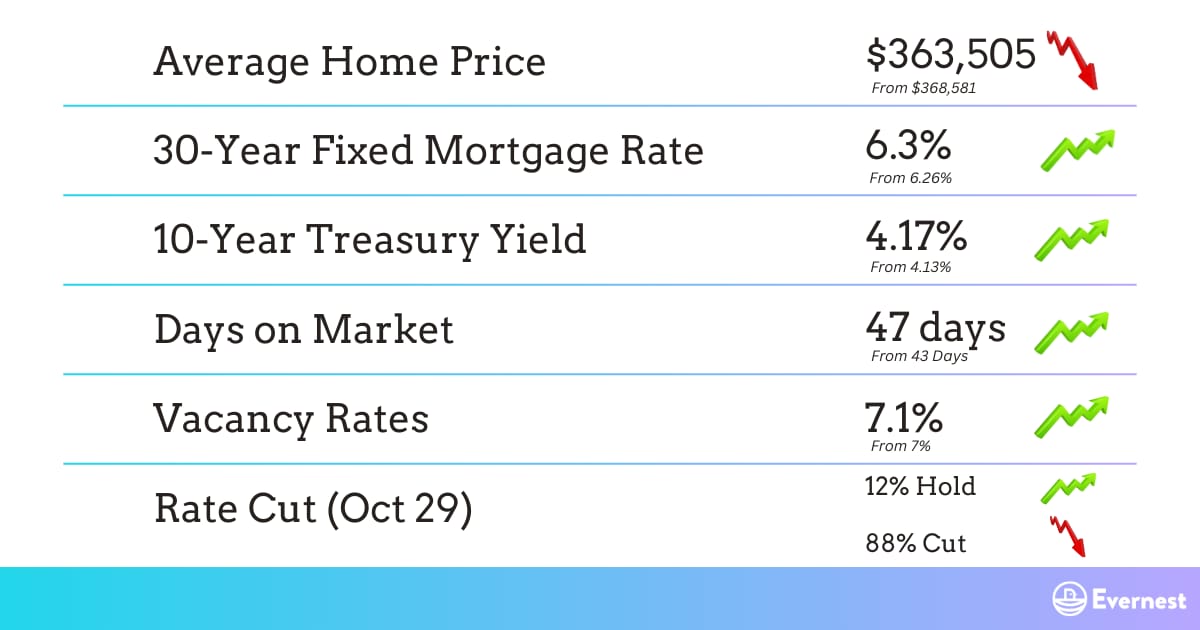

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

RENTERS UNION

Story: Over 1,000 tenants from five states are rallying together to unionize across Capital Realty Group’s expansive portfolio. Capital Realty, one of the largest private equity firms in the affordable housing sector, has properties in 28 states, with over 22,000 units under management. Tenants are pushing for sector-wide bargaining to tackle long-standing issues like mold, pest infestations, and neglected repairs across a corporate portfolio. This marks a pivotal moment in the growing trend of tenants organizing to fight for their rights, with their eyes set on better living conditions, collective bargaining rights, and a unified front against their corporate landlord.

So What? This unionizing effort is one of the first to challenge a large corporate landlord at this scale. It’s setting the stage for a new era in tenant rights, particularly in affordable housing, and it could open the floodgates for future union drives across the sector. If successful, this could change how tenants negotiate for better living conditions and affordable rents, impacting not just Capital Realty but other corporate landlords nationwide.

What’s Next? The next few months will be crucial. As the Tenant Union Federation continues its push for sector-wide bargaining, it remains to be seen whether Capital Realty will yield to these efforts or fight them. The outcome of this push could have far-reaching implications for tenant-landlord relationships, especially in affordable housing. Watch for updates on whether these early union successes in cities like Kansas City, New Haven, and Detroit turn into nationwide momentum, and how corporate landlords respond to this new form of tenant activism.

Source: Bloomberg

NEST PICKS

Top Weekly Stories:

1️⃣ SFR/Multifamily Management: Despite all the chatter about institutional landlords, small “mom-and-pop” landlords still dominate the single-family rental market, owning 89.6% of SFR properties. 🪺 More

2️⃣ Build-To-Rent: Gen X, millennials, and even Baby Boomers are flocking to the build-to-rent sector. With a growing demand for flexibility and low-density living, BTR homes are proving to be a hit across generations and could be a solid investment opportunity. 🪺 More

3️⃣ Mortgages: Despite the Federal Reserve’s recent rate cut, long-term rates continue to rise. 🪺 More

4️⃣ Interesting Trends: Tech hubs like San Francisco, Seattle, and Austin are seeing job cuts and slowing growth. As the economy adapts to AI and a post-pandemic world, these cities may lose their crown as employment powerhouses. 🪺 More

5️⃣ Policy Changes: A bipartisan effort is underway with the RESIDE Act, which aims to transform vacant office buildings, malls, and motels into affordable housing through a pilot grant program. This legislation could provide a creative solution to the housing crisis by repurposing underused spaces while revitalizing local communities. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: How I Made $200,219 With One Real Estate Deal (Real Numbers | No BS)

🎙️ Podcast Highlight: How This Investor Built Their Dream Life With Real Estate | Jennifer Salisbury

📰 Article Highlight: Build-to-Rent: How Retail Investors Are Capitalizing on America’s Housing Shift

💸 Off-Market Deal: Virginia Off-Market Deal