Your weekly perch for all things real estate.

J-Pow went to Jackson Hole and basically said, “I might finally touch the thermostat.” Markets threw confetti, mortgage rates exhaled, and homebuilder stocks did a little cha-cha. Is this the long-awaited break for buyers?

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

POWELL BLINKS (A LITTLE)

Story: In his Jackson Hole keynote, Fed Chair Jerome Powell said the “balance of risks” is shifting from inflation to layoffs, signaling a possible September rate cut. Markets took the hint; long yields dropped, the Dow ripped +900 intraday, and 30-year mortgages hovered near a 10-month low around 6.58%. Powell tempered the party (aka don’t bank on sub-6% this year without a hard economic turn). Still, even this guidance gave homebuilders a 5% pop and re-ignited hopes for slightly cheaper borrowing. He also outlined a back-to-basics policy framework (flexible inflation targeting) that tilts more toward supporting employment if inflation and jobs diverge.

So What? A September cut (or even the strong hint of one) nudges deal math in your favor—DSCR improves at the margins, builder carry eases, and bridge-to-perm takeouts get a touch friendlier. Expect a sentiment bump rather than a buyer stampede: at ~6.6%–6.7%, affordability is still tight, which keeps price cuts and concessions in play. For SFRs, slightly lower rates can shorten renter “stickiness,” so protect occupancy with renewal perks or light option-to-buy pilots while you watch cap-rate/financing spreads for acquisition windows.

What’s Next? Circle Sept. 17 (FOMC) and prep now: refresh rate locks, shop lenders, and float buy offers that assume a modest cost-of-capital improvement without promising sub-6%. Track weekly Freddie Mac prints, rate-lock volumes, and builder incentives to see if sentiment turns into contracts; keep an eye on MBS spreads to gauge how much of Powell’s tone actually flows into mortgage pricing. Finally, read the Fed’s statement language, and if employment risks get top billing, the path for additional easing (and your refi ladder) gets clearer.

Source: Realtor.com

NEST PICKS

Top Weekly Stories:

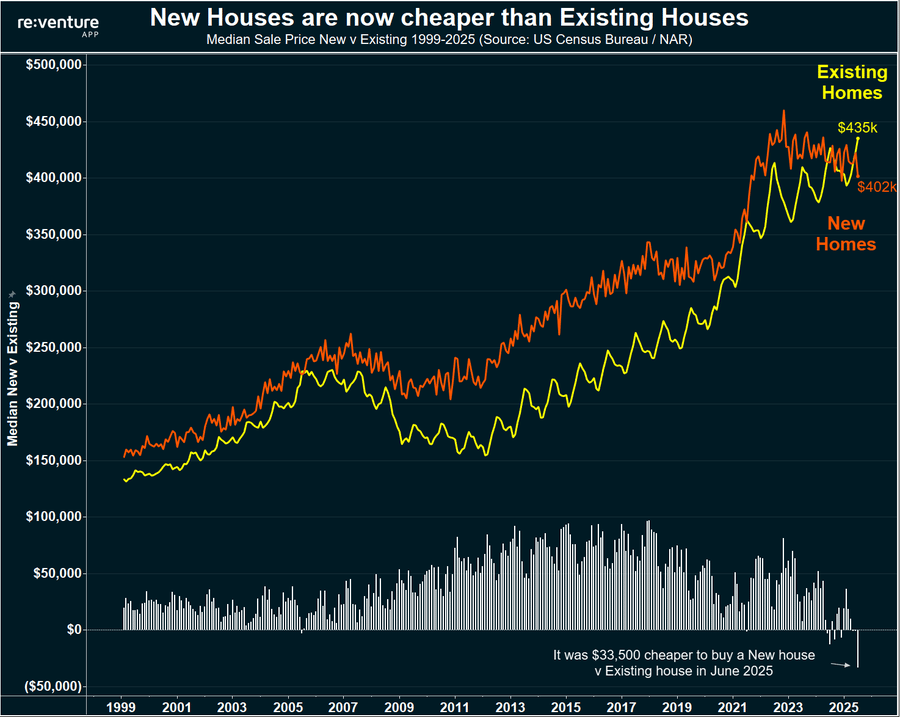

1️⃣ SFR/Multifamily Management: It’s materially cheaper to buy new construction than existing in many markets, a strong tailwind for builders. 🪺 More

2️⃣ Insurance: Florida Peninsula Insurance seeks meaningful premium cuts for ~170k policies, evidence that reforms + cheaper reinsurance can finally bend the curve.🪺 More

3️⃣ Mortgages: 30-year fixed at 6.58% held steady into Powell’s speech; applications are outpacing 2024, but many buyers remain rate-watchers (a September rush?). 🪺 More

4️⃣ Interesting Trends: Carlyle’s latest fund targets residential, self-storage, industrial, and pointedly avoids office/retail, a clear signal on where institutional money sees durable alpha. 🪺 More

5️⃣ Policy Changes: Bill Ackman floats combining Fannie & Freddie to cut costs and mortgage rates; the GSE plotline keeps getting spicier with IPO chatter swirling. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: It Took Me 20+ Years to Learn What I’ll Tell You in 27 Minutes

🎙️ Podcast Highlight: From Selling Cars to 75 Deals a Year in Real Estate: Josh Jarboe

📰 Article Highlight: How to Use Home Equity to Build Wealth

💸 Off-Market Deal: Alabama Off-Market Deal