Your weekly perch for all things real estate.

Turns out “summer leasing season” showed up early, grabbed a latte, and left by March. While landlords were icing coolers for July, renters were already signing in hoodies and mittens. Let’s talk about why the rent peak slid into Q1, what it means for pricing power, and how to work the new calendar before everyone else reads the memo.

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

PEAK SEASON FIZZLES

Story: Apartment List says the rental market’s once-sharp summer spike is flattening and shifting earlier. Pre-2020, rents typically rose Feb–Aug with a May peak of +1.0%. From 2023–2025, growth is Feb–July, peaking in March at just +0.6%. Three forces are driving the remix: the pandemic’s one-time timing shock that reset renewal cycles; operators deliberately staggering lease expirations (think 13–15 month terms) to smooth ops; and a supply-rich backdrop (1M+ new apartments since 2022) giving renters more options, more time, and more leverage. Regionally, the Sun Belt shows the most dramatic shift (Austin now reliably up only in March), while places like Boston keep the classic curve but with bigger winter/summer swings.

So What? If you price, market, or turn units as if “summer solves everything,” you’ll leave money on the table and vacancy in the books. Earlier peaks mean earlier campaigns (Q1, not Memorial Day), more surgical renewal offers (keep your best tenants off the summer cliff), and dynamic terms (13/14/15 months) to flatten your own seasonality. In supply-heavy metros, expect longer search windows, higher concession sensitivity, and more heads-up competition from new deliveries. In tighter Midwest markets, you’ll still see seasonality, just muted, so don’t over-incentivize where you don’t have to.

What’s Next? Some drivers fade (super-high new-build volume), others stick (remote work flexibility; operator playbooks that smooth expirations). For 2026, plan: (1) Q1 marketing and renewal campaigns front-loaded in Feb–Mar, (2) lease-term mixing to avoid a single “big bang” turnover month, (3) concession calendars that taper before summer instead of ramping into it, and (4) market-level playbooks (e.g., Sun Belt = earlier/softer peak; coastal/mountain markets = longer searches, more concessions). Track: delivery pipelines, Q1 lead velocity, and renewal acceptance on 13–15 month terms.

Source: Apartment List

The SFR leasing environment is sending mixed signals. The strategies that worked last year aren’t all holding up. Join Evernest’s Director of Leasing Brett Drevlow and Pricing Manager Bryan Shaw for a live webinar where we’ll break down what we’re seeing across demand, pricing, and renter behavior—and what it means for leasing performance in the months ahead.

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Zillow forecasts modest home price growth (+1.2% next 12 months), a small uptick in 2026 sales, and a split rental outlook (SFR up ~2.2%, multifamily ~-0.1%). Translation: more leverage for renters in big-supply metros, steady demand for SFRs. 🪺 More

2️⃣ Investors: A new survey finds 73% of Americans blame investors for housing affordability; public sentiment risk is now officially part of your acquisition thesis. 🪺 More

3️⃣ Mortgages: Rates ticked up to ~6.09% after a brief glidepath lower; policy noise and choppy Treasuries keep the near-term outlook bumpy, so lock opportunistically and underwrite with a volatility buffer. 🪺 More

4️⃣ Interesting Trends: Inheritances hit a record share, but tax incentives and aging-in-place keep supply tight where you want it loosened. 🪺 More

5️⃣ Policy Changes: The administration cools on penalty-free 401(k) down payments, so don’t count on retirement accounts to juice first-time buyer demand this spring. 🪺 More

INVESTOR HIGHLIGHTS:

🎙️ Podcast Highlight: I Offered a Squatter $7,000 to Leave… They Refused

📰 Article Highlight: How to Get Started in Real Estate Investment in 2026

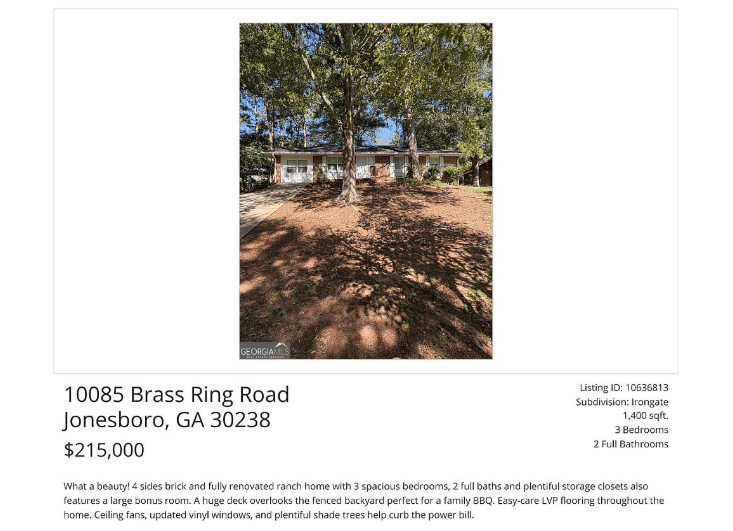

💸 Off-Market Deal: South Atlanta 3-Bedroom Ranch Deal