Your weekly perch for all things real estate.

Here we are, the final perch of 2025. The market is thawing just enough to negotiate a little harder, underwrite a little smarter, and maybe smile at your cap table again. Below: what DC might cook up for affordability, where buyers have the leverage, and how to play the slow-cook reset of 2026. Wishing you all a safe, happy New Year! See you on the other side with fresh deals and stronger NOI.

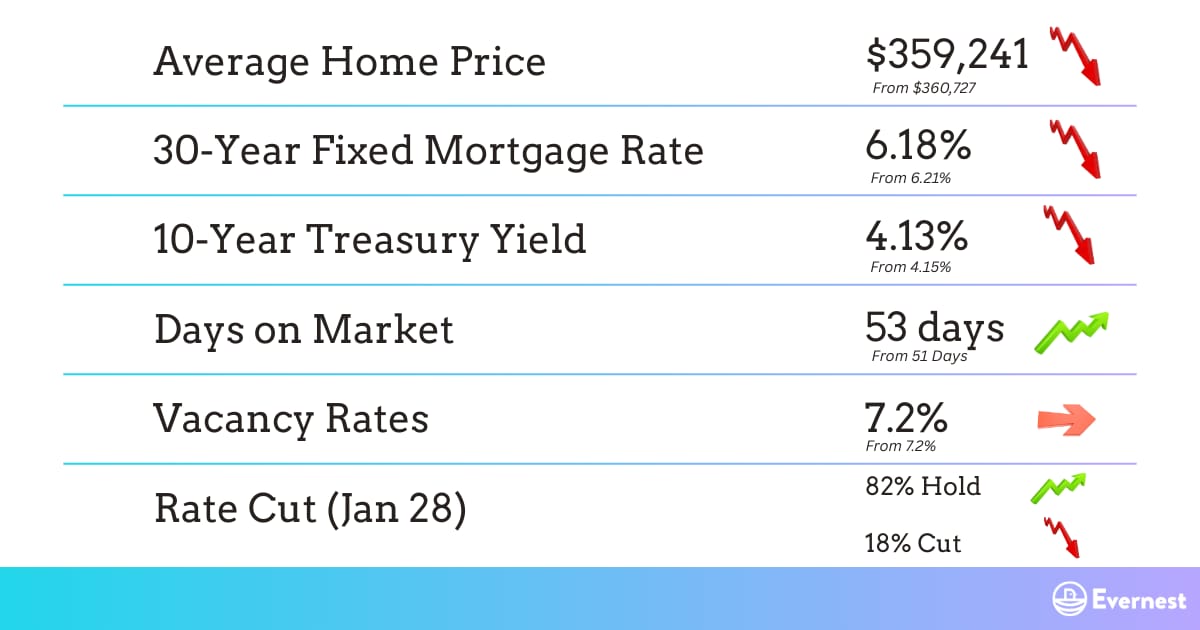

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

HOUSING POLICY COOKING

Story: After a multi-year deep freeze, 2026 is shaping up as a thaw not a melt. Economists expect rising incomes to finally outpace home prices, while mortgage rates hang just above 6% and inventory loosens as more rate-locked owners capitulate. Think “The Great Housing Reset” (Redfin’s phrasing) rather than a boom: national prices likely hover near flat (+~0.5%), with some markets (FL/TX/CA pockets) already showing modest roll-backs from 2025 peaks. The White House, meanwhile, is signaling “aggressive” affordability measures, ranging from permitting and regulatory streamlining to incentives for faster approvals, although specifics remain under wraps. Translation: policy headlines will be loud; the market shift will be gradual.

So What? For investors and operators, “flat-ish” prices, combined with slightly easier rates, equals a classic spread game: negotiate harder on acquisitions, underwrite rents conservatively, and hunt for motivated sellers in buyer-tilted submarkets. If incomes outrun prices, payment-to-income ratios improve without a price crash, supporting steadier occupancy. Expect cap-ex and insurance to continue squeezing NOI, so your edge lies in buying discipline (concessions, closing credits, buydowns) and asset selection (homes with low ongoing operating expenses). If you’re waiting for a 2010-style discount bonanza… this isn’t it. It’s the boring, profitable middle: disciplined buys, realistic rent growth, and operational excellence.

What’s Next? Q1–Q2 2026: watch for incremental rate relief, listing upticks, and whether buyer confidence rebounds with labor-market headlines. If DC rolls out permitting or “reward the builders” incentives, the impact is evident with a lag… Think a later 2026/2027 pipeline. Near-term, look for: (1) more sellers testing the market, (2) price cuts/concessions where supply stacks up, (3) rents re-accelerating slightly (2–3% by late-2026) as for-sale stays pricey for many households. Keep your eye on policy “trial balloons” (portable/assumable/50-year talk) but run your deals on today’s math, not tomorrow’s maybe.

Source: CNN

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: There are 37% more sellers than buyers nationally, the widest gap (outside last summer) since 2013. Translation: buyers hold leverage, with concessions and price cuts back in vogue. 🪺 More

2️⃣ Rents: National median rent across top 50 metros fell to $1,693 (-1% YoY), marking a 28-month streak of YoY declines; affordability for minimum-wage pairs improves in a few metros, with more to join in 2026. 🪺 More

3️⃣ Mortgages: MBA says total mortgage applications fell 5% WoW; purchase apps dipped 4% even as rates nudged lower—soft labor, sticky costs, and holiday seasonality keep demand cautious. 🪺 More

4️⃣ Interesting Trends: Zillow’s 2026 outlook: home values +1.7%, existing sales up to 4.3M, SFR rents +1.6% while multifamily rents -1%—a gentle reset, not a rocket ship. 🪺 More

5️⃣ Policy Changes: DOJ urges strict antitrust scrutiny of buyer-broker commission practices in the Davis v. Howard Hanna case; outcomes here could reshape fee structures and transaction economics in 2026. 🪺 More

INVESTOR HIGHLIGHTS:

🎙️ Podcast Highlight: 5 Rookie Real Estate Investing Mistakes

📰 Article Highlight: The Ultimate Guide to Choosing a Property Manager

💸 Off-Market Deal: Easy Pine Lawn SFR Flip or Rental