Your weekly perch for all things real estate.

Nevada just tried to fix its 100,000-unit housing shortage with… wait for it… a bill that would limit investors to buying fewer than 100 homes a year. Yes, nothing screams “more housing” like telling the people who actually build and buy homes to please slow down. The bill failed by a single vote, but the deciding legislator immediately posted a video saying he voted no while “full of anger and fury,” which feels like the perfect metaphor for U.S. housing policy in 2025

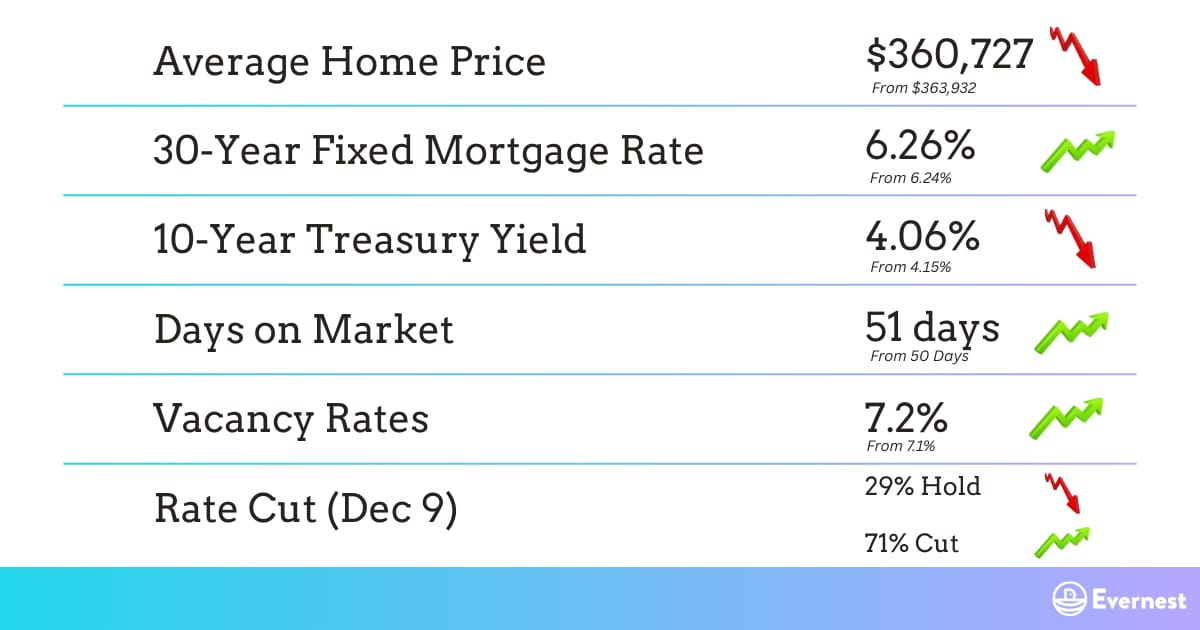

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

PROBLEM….FIXED?

Story: Nevada’s SB391 (aka the “Please Don’t Invest Here” Act) tried to cap real estate investors from buying more than 100 single-family homes per year. Apartments? Mobile homes? Exempt (but only because someone remembered at the last minute that Nevadans actually live in those). The bill lost by one vote, but the deciding legislator immediately went online to say he voted “no” while brimming with “anger and fury” due to misinformation. A consistently reassuring sign for future policymaking. The aim: crack down on “corporate landlords.” The reality: Las Vegas desperately needs investors and supply. The metro is short 100K+ units, rents have surged, and the city is building like it’s the Midwest… slowly… but with Sun Belt-level demand.

So What? For investors, this is the kind of political theater that matters. Local sentiment is shifting, and policymaker frustration is being aimed (often inaccurately) at rental investors. Even failed bills can create a market chill, characterized by higher uncertainty, slower deal velocity, and the development of risk premiums (good for yield hunters, but bad for local affordability). And Vegas specifically? It desperately needs institutional capital, not because BlackRock wants another cul-de-sac, but because the average household can’t qualify for a mortgage under current lending standards. Without investor capital, Las Vegas risks drifting toward California-level shortages but without the wages, transit, or In-N-Out density to support it. If SB391 is any indication, Nevada’s policymaking will continue mixing populism with poor math.

What’s Next? Expect more attempts at “corporate landlord” crackdowns, both at the state and federal levels. Nevada Congresswoman Susie Lee is already capitalizing on the narrative, despite the shaky statistics. As affordability worsens and homelessness rises (Vegas is already skating on thin ice here), political pressure for quick fixes will increase. Watch the 2026 session: similar bills will almost certainly return, possibly with tighter language and even fewer exemptions.

Source: Nevada Independent

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Nearly one-third of U.S. adults 18–34 now live with Mom and Dad, with New Jersey leading at 44%; because the only thing higher than rents are EZ-Pass fees. 🪺 More

2️⃣ Build-to-Rent: High mortgage rates + Millennial/Gen Z preferences + Boomer downsizing = BTR’s Golden Era, with investors chasing rising SFR rental demand in the suburbs. 🪺 More

3️⃣ Mortgages: The Freddie Mac 30-year rate nudged to 6.26% while the government shutdown delayed key job data, leaving policymakers flying blind ahead of December’s meeting. 🪺 More

4️⃣ Interesting Trends: The delayed data report shows 119,000 jobs added, unemployment rising to 4.4%, and wage growth still outpacing inflation, setting the stage for a tricky Fed decision. 🪺 More

5️⃣ Policy Changes: Powell’s term ends in May, and Trump says he “already knows” his pick. Five candidates are in the mix, but markets are preparing for a very different Fed in 2026. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: Old vs New Rental Property: Which Is A Better Investment?

🎙️ Podcast Highlight: Why More Investors are Choosing Build-to-Rent Properties in 2025

📰 Article Highlight: Simple Rules for Finding the Right Investment Property

💸 Off-Market Deal: Southwest Rental Special - $250,000