Your weekly perch for all things real estate.

Cincinnati just did the impossible… It dethroned Washington, D.C., as America's hottest rental market. Yes, chili-on-spaghetti Cincinnati, proving that renters are officially overpaying for coastal prices, for the privilege of complaining about traffic. The Midwest is having its main character moment with 11 cities in the top 30, while D.C. landlords are learning that "prestige location" doesn't hit quite as hard when government workers are job-hunting.

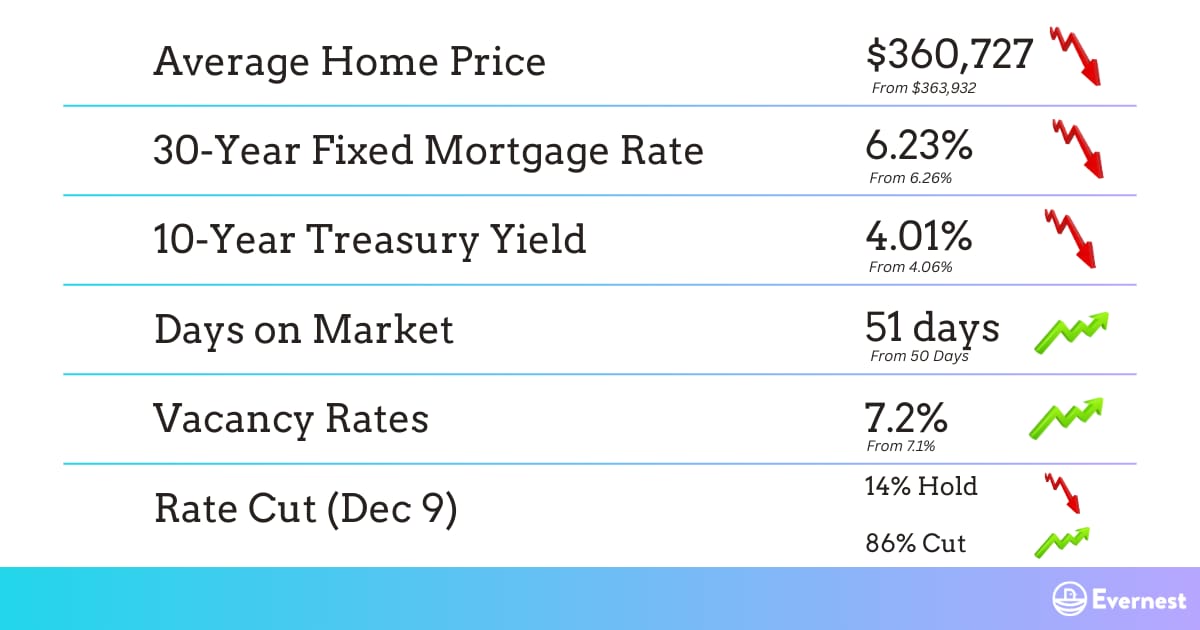

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

CINCINNATI CROWNED

Story: Cincinnati just pulled off the upset of the year, climbing four spots to knock Washington, D.C. out of the top rental market position it held for nearly a year. The Queen City saw page views surge 34%, favorited listings jump 52%, and saved searches explode 56% in Q3 2025. The bigger story? The Midwest is absolutely dominating, claiming 11 of the top 30 most sought-after rental markets. Las Vegas crashed the top five party, while Long Beach made its top-10 debut. Meanwhile, St. Louis had the glow-up of the century, rocketing up 74 positions.

So What? This isn't just a game of musical chairs with city rankings; it's a fundamental shift in where renters perceive value. Property managers and investors in Midwest markets should be celebrating (and possibly raising rents strategically), while coastal landlords may want to verify if their "premium location" pricing still holds water. The data shows renters aren't just browsing anymore, they're saving listings, setting alerts, and getting tactical about their searches. Translation: when they inquire about your property, they're serious. For investors, this signals that Midwest markets are no longer the "backup plan"… They're the main event, offering better value and faster-moving inventory than their coastal counterparts.

What's Next? Watch how this trends into 2026's spring rental season (typically March-June). If the Midwest maintains this momentum, expect more institutional investors to enter these markets, potentially driving up acquisition costs while also validating the region's fundamentals. Keep an eye on whether D.C.'s slide continues (government workforce changes could be the canary in the coal mine). For property managers, this is the time to optimize listings in high-engagement cities: better photos, faster response times, and competitive pricing will be crucial as renters become more sophisticated in their searches.

URL Source: RentCafe

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Home sellers are slashing prices by a record $25,000 (cumulative) as they desperately try to move inventory in the most active fall market since 2022. 🪺 More

2️⃣ Rents: National rents fell for the fifth straight month with one-bedrooms down to $1,501 and two-bedrooms at $1,880, but San Francisco is living in its own reality with rents surging 15.9% annually while Arizona markets are getting absolutely pummeled with 7-10% drops thanks to oversupply. 🪺 More

3️⃣ Mortgages: Mortgage applications inched up 0.2% despite rates climbing to 6.4% (the highest since early October), with government-backed loans experiencing their strongest week since 2023 as buyers increasingly rely on FHA, VA, and USDA programs to make homeownership more affordable. 🪺 More

4️⃣ Interesting Trends: Building material prices are rising at their fastest clip since January 2023, up 3.5% year-over-year, as energy input costs jumped for the first time in over a year. Bad news for builders' margins and anyone planning a renovation who thought inflation was yesterday's problem. 🪺 More

5️⃣ Policy Changes: FHFA raised the 2026 conforming loan limit to $832,750 (up just 3.25%, the smallest increase in years), signaling a cooling housing market, while high-cost areas can now go up to $1,249,125. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: Biggest MISTAKES I Made On My First Rental Property (I Lost Thousands $$$)

🎙️ Podcast Highlight: Real Estate Expert Reacts to TikTok "Gurus"

📰 Article Highlight: How the Wealthy Actually Use Real Estate to Build Wealth

💸 Off-Market Deal: Southwest Rental Special