Your weekly perch for all things real estate.

Google just showed up to the open house with a megaphone and a “Request a Tour” button, and suddenly the portals are checking their comps. If this experiment scales, the first click, the first lead (and maybe your ad budget) now answer to Mountain View. Grab a cookie; the SERP is the new foyer.

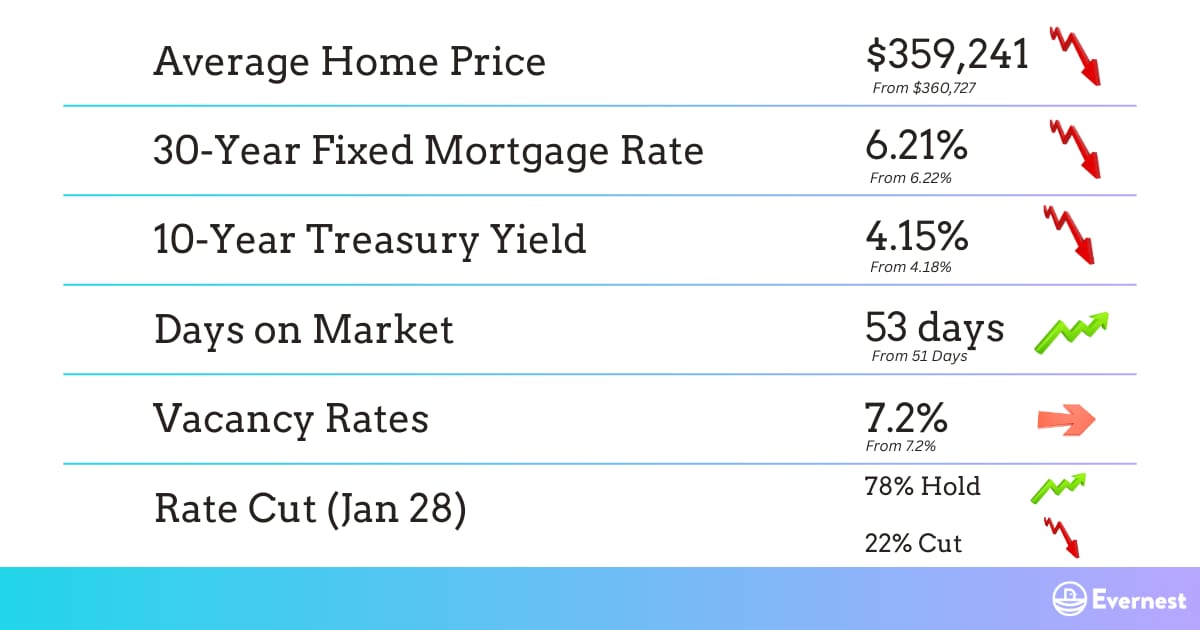

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

GOOGLE CRASHES THE (MLS) PARTY

Story: Google is testing a new way to surface full listing cards directly on mobile search results (price, photos, basics, and a shiny “Request a tour” button) via HouseCanary’s IDX site ComeHome. The pilot is live in select markets and, per HouseCanary, coordinated with local MLSs as a “controlled experiment.” Déjà vu for publishers: when Google rolled out AI summaries, many sites reported big traffic losses; investors clearly noticed the potential rhyme as Zillow’s shares fell more than 8% on Dec 15. Analysts are split: some call the fears overblown given Zillow’s heavy direct/app traffic, others see a longer-term risk and a path for Google to auction “listing ad units.” Meanwhile, industry voices warn the test could blur IDX norms if listings morph into ad inventory.

So What? If Google keeps buyers in-SERP longer, your lead funnel gets re-plumbed. Portals could pay Google for placement, agents could see rising PPC costs on the very listings they created, and organic SEO might convert less as consumers tour/convert before clicking through. For owners/operators, the power shift is about who owns the first touch: if it’s Google, expect more “pay to play” for visibility, tighter attribution, and new fraud/quality-control pressures on instant tour requests. Translation for investors: watch customer acquisition costs across portals and brokerages, margin pressure if auctions heat up, and strategic pivots (data partnerships, app retention, and My Business-style listing controls).

What’s Next? Track scope creep: (1) expansion beyond the pilot metros, (2) desktop and Maps integration, (3) whether MLSs object to ad-monetized usage, (4) earnings call language from Zillow/Realtor.com/Homes.com about traffic mix, and (5) Google’s monetization model (auctioned placement vs. partner rev-share). If this graduates from “experiment” to standard SERP modules in 2026, budget for higher CPCs on listing-intent keywords, tighten lead routing/UTMs, and beef up instant-response SLA, speed-to-lead will matter even more.

Source: GeekWire

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Pending sales slide into the holidays by falling 5.8% YoY for the four weeks ending Dec 14, the biggest drop since early 2025. 🪺 More

2️⃣ Rentals: Zillow’s Nov report shows asking rent down 0.3% MoM to $1,925, with ~39% of listings offering concessions; Sun Belt/Mountain metros lead declines as new multifamily supply keeps vacancy (and negotiating power) elevated. 🪺 More

3️⃣ Mortgages: With delayed job data showing unemployment at 4.6% and the CPI cooling to 2.7%, mortgage rates remained steady this week. Affordability is better than mid-summer but still tight, setting a cautiously optimistic glide path into early 2026. 🪺 More

4️⃣ Interesting Trends: Core CPI sits at 2.6% (lowest since 2021) and headline 2.7% bolster the case for additional easing in 2026. 🪺 More

5️⃣ Policy Changes: Feds hint at affordability action in 2026 with Lennar saying Washington is engaging builders and could roll out measures next year as incentives chew current margins (~14% of price in Q4). 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: Is This House Worth $150,000? (Full Deal Breakdown)

🎙️ Podcast Highlight: I Bought My First Commercial Property… (Then Everything Went Wrong)

📰 Article Highlight: 26 Things Investors Should Know About Build-to-Rent Housing in 2026

💸 Off-Market Deal: Hathaway Manor Beauty