Your weekly perch for all things real estate.

August rent didn’t ghost you, but it’s still showing up fashionably late. After a rough summer slide, on-time payments at mom-and-pop rentals ticked up to 83.2%, but we’re still nursing a year-over-year hangover. Think of it as your tenant finally Venmo’ing on the 5th… progress, not perfection.

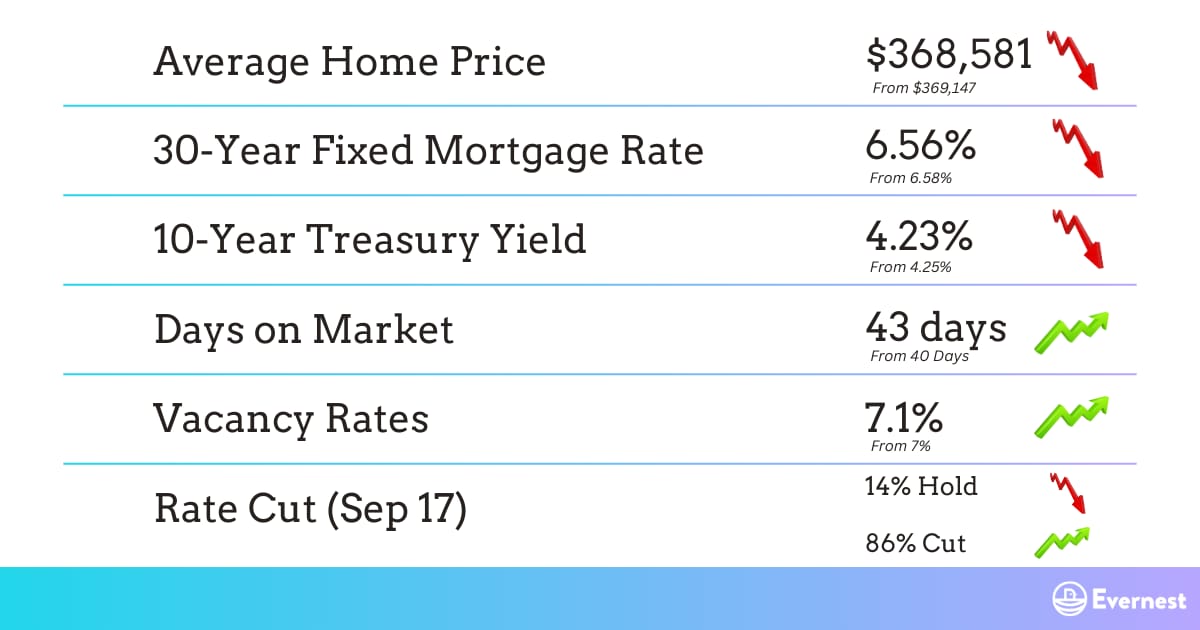

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

LATE RENTS

Story: A new report shows that on-time payments in independently operated rentals rose 34 bps to 83.2%, while July was revised to 82.9%, a post-pandemic low. Year over year, on-time still trails by 216 bps, marking 25 straight months of annual deterioration (-502 bps since the streak began). The forecasted full-payment rate climbed to 93.3% (up 43 bps), helped by more tenants paying late but eventually paying. By product type, 2–4s lead (83.8%), SFRs follow (83.3%), and small multifamily trails (82.1%).

So What? For operators, cash flow is less about “paid or not” and more about when it lands. Rising late-but-paid behavior props up full collections but squeezes working capital, taxes patience, and makes late-fee policy, autopay enrollment, and proactive outreach worth their weight in NOI. If you’re underwriting acquisitions or renewals, consider trimming assumed on-time collections 50–100 bps, biasing to 2–4s and SFRs where performance is slightly stronger, and sizing DSCR with a little extra cushion.

What’s Next? Watch the next two prints for confirmation that July’s dip was the bottom, seasonality, and any September rate cut could nudge on-time higher. Track labor market softness, sub-40 borrower delinquencies, and insurance/utility creep that crimp tenant budgets. Operator playbook for Q4: push autopay, offer structured payment plans over ad-hoc promises, test small early-pay credits where legal, and tighten renewal screens in weaker submarkets.

Source: Chandan

NEST PICKS

Top Weekly Stories:

1️⃣ SFR/Multifamily Management: The SFR market is splintering: premium tiers (and cities like Chicago/NYC) are hot, entry-level growth is cooling as new supply and BTR townhomes crowd the lane. 🪺 More

2️⃣ Insurance: Homeowners insurance is the third wheel in the affordability equation, projected to hit $3,520 average in 2025 (up 8% this year after double-digit jumps). T: Budget your capex and reserves accordingly. 🪺 More

3️⃣ Mortgages: With the 30-year hovering around 6.58%, monthly payments fell to 2025 lows and pending sales +1.6% YoY. Green shoots, but many buyers are still rate-watching from the sidelines. 🪺 More

4️⃣ Interesting Trends: Small multifamily finally posted YoY price gains, with cap rates steady and LTVs inching up as credit conditions normalize and momentum building for sub-$9M debt. 🪺 More

5️⃣ Policy Changes: Congress’s trigger-leads crackdown moves to opt-in only and is hailed as consumer protection, but panned as a competition killer; expect changes to lead funnels and cost of borrower acquisition. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: NEVER Buy A Rental Property HERE... You'll LOSE Money

🎙️ Podcast Highlight: Start Investing in Real Estate With Just $100 (Here's How)

📰 Article Highlight: How to Use Home Equity to Build Wealth

💸 Off-Market Deal: Georgia Off-Market Deal