Your weekly perch for all things real estate.

Inflation is cooling… but not fast enough to stop the Fed from sweating. Add in sluggish growth, sticky prices, and a tariff-fueled spending spree, and we’re now flirting with that economic buzzkill known as stagflation.

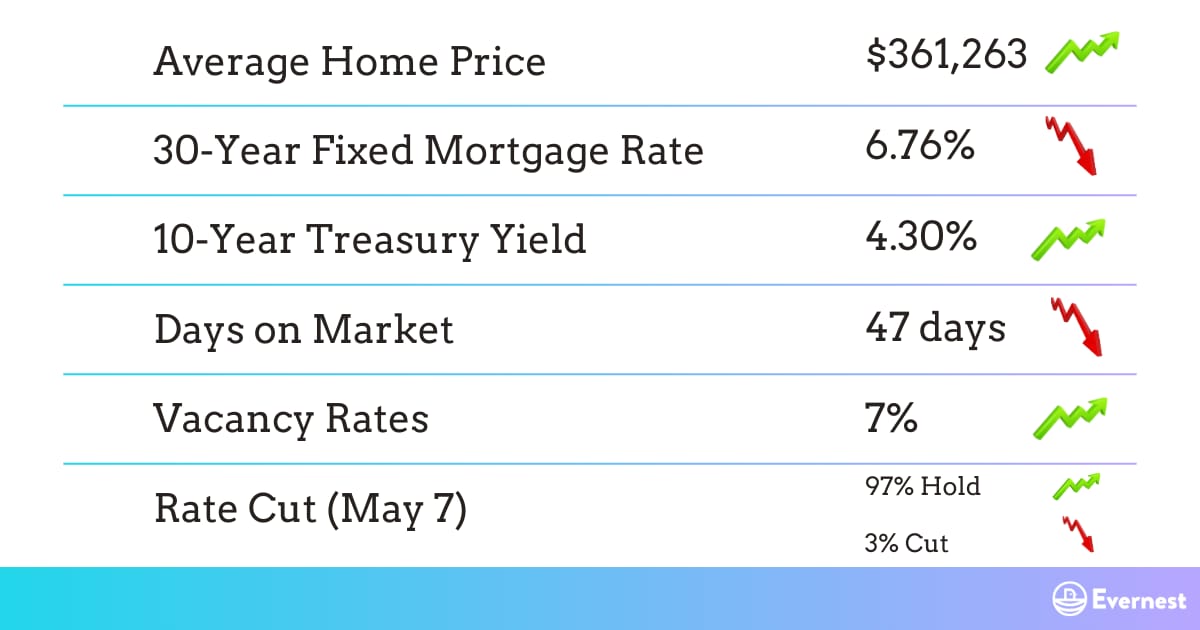

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

STAGFLATION?

Story: The Fed’s go-to inflation gauge — the PCE Price Index — clocked in at 2.6% year-over-year in March, slightly down from February and still floating above the 2% comfort zone. Meanwhile, Q1 GDP came in weak, and consumer spending surged as buyers raced to beat new tariffs on goods. The combo of sluggish growth and sticky inflation has economists throwing around the “S-word”: stagflation. As if that weren’t enough, the jobs market is holding firm, complicating any dreams of a Fed rate cut. Wall Street took the news with all the chill of a broken HVAC unit — the Dow dropped 700 points.

So What? For real estate investors, this is a signal flare. Rising costs + slower growth = thinner margins and jittery financing. If the Fed doesn’t cut soon, borrowing costs remain elevated, and cap rates stay compressed. But if they do cut into a still-inflationary environment? We may get relief on mortgage rates… paired with lower asset values. That’s not a win-win — it’s more like a draw-draw.

What’s Next? All eyes are on tomorrow's May FOMC meeting (97% odds of a hold). If employment starts to crack or consumer spending pulls back hard, expect renewed rate cut speculation. But until then, expect the Fed to stay cautious — and investors to stay caffeinated. Monitor treasury yields, bond demand, and market reactions to upcoming inflation data on May 13.

Source: Yahoo! Finance

NEST PICKS

Top Weekly Stories:

1️⃣ SFR/Multifamily Management: The average seller is asking nearly $39K more than buyers are willing to pay — the most significant gap since the pandemic. Spoiler: buyers aren’t budging. 🪺 More

2️⃣ Insurance: Homeowners insurance rates have risen from an average of $2,656 in 2021 to $3,303 in 2024, a 24% increase, and over 50% in some states. 🪺 More

3️⃣ Mortgages: Morgan Stanley says mortgage rates will steadily decline into 2026 as treasury yields slowly fall. 🪺 More

4️⃣ Interesting Trends: Airbnb sees signs of a possible travel slowdown — Demand is still steady, but growth might be headed for a nap. 🪺 More

5️⃣ Policy Changes: A stronger-than-expected April jobs report pushed bond yields higher, giving the Fed more room (and fewer excuses) to delay rate cuts. 🪺 More

INVESTOR HIGHLIGHTS:

👉 Article highlight: Tips for Renting a House

👉 Off-Market Deal: Florida Off-Market Deal