Your weekly perch for all things real estate.

Washington’s latest affordability hack is to stretch mortgages to half a century. Because if you can’t lower the price, you can always extend the timer. The 50-year loan promises slightly smaller monthlies, vastly bigger lifetime interest, and a reminder that in housing, there’s no such thing as a free lunch… just a very long tab.

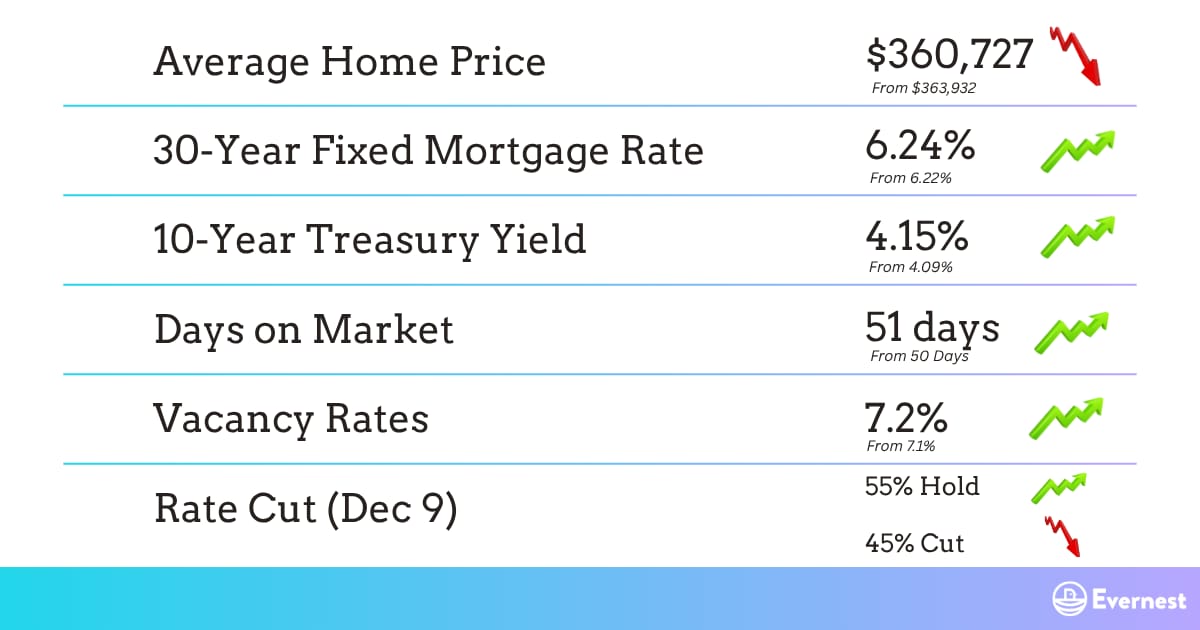

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

STRETCHED TERMS

Story: Housing affordability is tight enough that the White House is floating a 50-year mortgage to trim monthly payments. Expect a rate premium over the 30-year (HousingWire’s Logan Mohtashami pegs it at ~42–57 bps higher); therefore, if the 30-year rate sits at ~6.22%, a 50-year rate might land at ~6.64%–6.79%. On a $400K loan, that stretches P&I from roughly $2,455 (30-yr @ 6.22%) to about $2,297 (50-yr @ 6.64%)—a ~$158/month (-7%) break. The tradeoff is brutal in terms of lifetime cost and equity build: the 50-year term roughly doubles the total interest (~$980K vs. ~$483K in a 30-year example) and leaves you far more leveraged for far longer.

So What? For investors and operators, a 50-year option is more akin to “payment engineering” than a cure for affordability. It could nudge a few renters into ownership at the margin (slightly easing rental demand). Still, the bigger implication is behavioral: slower amortization = thinner early equity cushions = higher sensitivity to price dips, turnover costs, and life events. If it catches on, even modestly, expect longer average hold times, more cash-on-cash-driven decisions, and renewed focus on assumability/portability mechanics. Translation: helpful in select, high-cost markets or for payment-constrained buyers, but don’t plan your acquisition pipeline around a demand surge.

What’s Next? Watch three things: (1) Policy clarity—whether FHFA/Treasury gives this oxygen or pivots to alternatives (assumable/portable mortgages). (2) Rate path—a 25–50 bp move in 30-year rates can erase the 50-year’s monthly “benefit” without the lifetime interest penalty. (3) Market reception—lenders’ appetite, investor take-up, and any pilot program guardrails (DTI caps, LTV limits, MI overlays). If momentum stalls, expect the conversation to shift back to supply-side fixes and targeted buy-down programs rather than ultra-long amortizations.

Source: NPR

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Pending home sales -0.3% YoY (four weeks ending Nov 9) as buyers wait for sub-6% rates; DOM stretched to 49 days, longest for this season since 2019. 🪺 More

2️⃣ Build-to-Rent: The new-home price premium is near a record low, and Lennar’s Investor Marketplace is courting mom-and-pop landlords. Translation: turnkey rentals with warranty and fewer cap-ex surprises. 🪺 More

3️⃣ Mortgages: Mortgage delinquencies ticked up to 3.99% in Q3; stress is concentrated in FHA cohorts as taxes/insurance pinch budgets. 🪺 More

4️⃣ Interesting Trends: The hidden costs of ownership now average $15,979/yr (maintenance, insurance, taxes); that’s ~$1,330/mo before a single mortgage dollar. 🪺 More

5️⃣ Policy Changes: FHFA is evaluating assumable and portable mortgages. Assumables have a path; portables face scale/safety hurdles, but could be a game-changer if executed. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: What is Build-to-Rent Investing? (And Why It’s Exploding in 2026)

🎙️ Podcast Highlight: Why I Left Tech to Develop Real Estate | Dave Barker

📰 Article Highlight: The 5 Biggest Mistakes New Flippers Make (And How to Avoid Them)

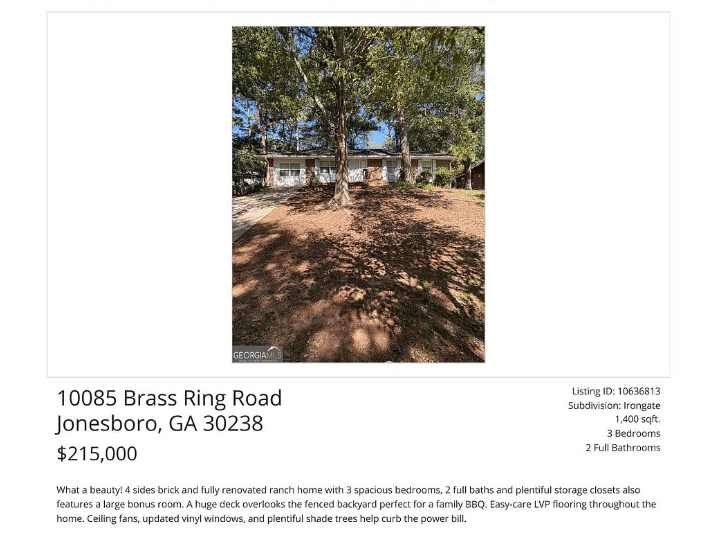

💸 Off-Market Deal: South Atlanta 3-Bedroom Ranch Deal - $215,000