Your weekly perch for all things real estate.

The housing market is finally sobering up from its pandemic bender, and 2026 is the year it starts drinking water and taking walks instead of doing tequila shots with mortgage rates. According to Redfin, we’re entering the ‘Great Housing Reset’, where prices stop sprinting, wages quietly catch up, and investors trade FOMO-fueled chaos for a slow, steady grind. If you like predictable cash flow, better entry points, and fewer “what is happening” phone calls from your tenants, this is your kind of year.

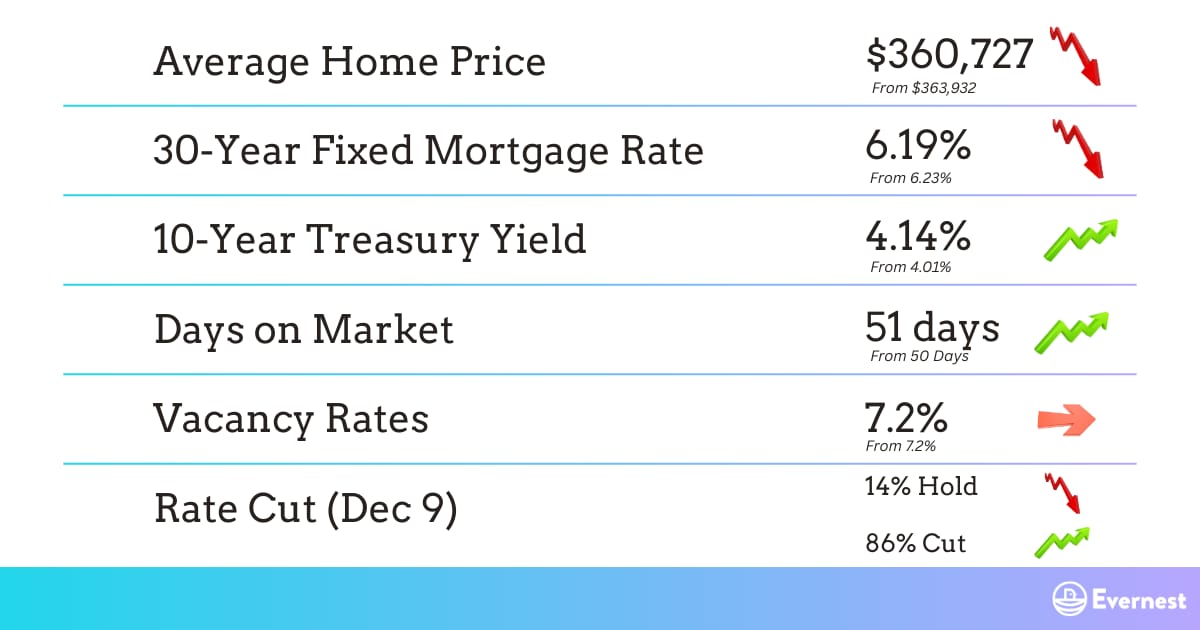

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

2026 PREDICTIONS

Story: Redfin just dropped its 2026 outlook, and good news: the housing market is finally crawling out from under the anvil it’s been bench-pressing since 2020. They’re calling this the Great Housing Reset, a slow-motion “we’re gonna be okay” montage where affordability improves. Not because prices fall much, but because wages finally outrun home prices for the first time since flip phones were still socially acceptable. Mortgage rates settle into the low-6% range, home prices inch up just 1%, and sales rise 3%. Meanwhile, rents creep higher, roommates become a lifestyle brand, multigenerational households boom, and policymakers across the aisle suddenly discover they agree on at least one thing: housing is broken and needs fixing.

So What? For investors and operators, this isn’t a “rocket ship to the moon” market; it’s a “slow simmer, don’t burn the chili” market. Demand improves, but doesn’t explode. Sellers stay put because they’re sitting on low rates and substantial equity, and renters will continue renting because buying still feels like a luxury hobby. Expect rising refi volume (hello, HELOC season), more remodeling rather than moving, stronger apartment demand as supply thins out, and shifting hot spots: NYC suburbs, the Great Lakes, and Midwest cities outperform, while parts of Florida and Texas cool off faster than leftover Thanksgiving turkey. Climate risk also gets hyperlocal, pushing people out of at-risk neighborhoods.

What’s Next? Expect 2026 to deliver a gentle thaw, not a spring break. Watch mortgage rates: sustained dips into the high-5% range could unleash long-pent-up demand. Track where young adults and families go: roommate households, build-to-rent, and multigenerational living are becoming real investment opportunities, not fringe trends. Keep your eyes on the policy machine too; bipartisan momentum on zoning reform and manufactured housing could be the biggest supply unlock in a generation.

Source: Redfin

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Thanksgiving delivered more than dry stuffing; inventory is up, prices softened, and mortgage rates slid to 6.23%, giving buyers some long-awaited breathing room, even if consumer confidence still feels like it skipped dessert. 🪺 More

2️⃣ Build-to-Rent: The South is still the BTR capital of America, pumping out 36,840 homes in progress as builders race to meet demand from millions of new residents and a 4.7-million-unit national shortage. 🪺 More

3️⃣ Mortgages: Mortgage rates continued their gentle downward drift, with the 30-year sliding to 6.24% (the lowest in over a year), boosting refi activity and nudging existing-home sales to an eight-month high. 🪺 More

4️⃣ Interesting Trends: Investor purchases ticked up 1%, holding at 17% of all sales, but profits remain tight as losses rise and the rental market softens, making this the quietest investor market since “Tiger King” was trending for normal reasons. 🪺 More

5️⃣ Policy Changes: The FHFA is in the hot seat as the GAO investigates whether Director Bill Pulte used agency resources for… let’s say… creative criminal referrals in mortgage-fraud cases. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: Real Estate Is the Easiest Path To Financial Freedom (But There’s a Catch)

🎙️ Podcast Highlight: The Reality of Section 8 Investing (Nobody Warns You About This)

📰 Article Highlight: How to Find Motivated Sellers in 2026: A Guide to Finding Discounted Properties in Any Market

💸 Off-Market Deal: Cash-flowing 2BR in Midfield