Your weekly perch for all things real estate.

Fannie Mae and Freddie Mac just got handed a $200 billion shopping list for mortgage bonds; apparently, the solution to housing affordability is government-sponsored retail therapy. Will it actually move the needle on rates, or is this the financial equivalent of rearranging furniture and calling it a renovation? Grab your calculator and let's find out.

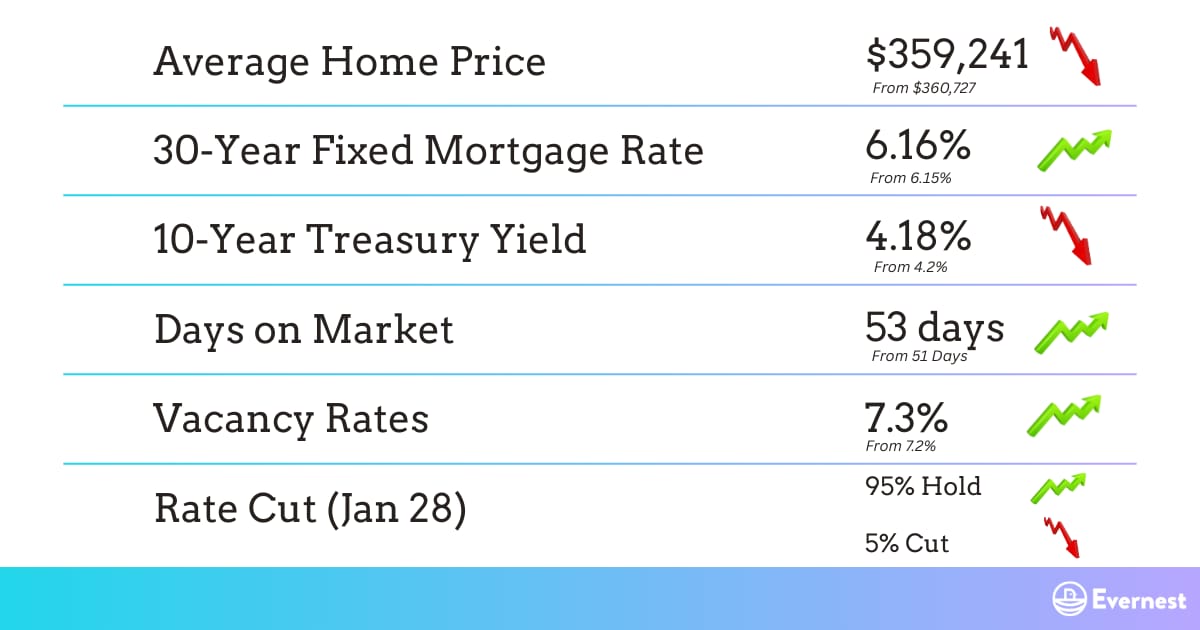

NEST NUMBERS

Source: Zillow, Freddie Mac, CNBC, Redfin, Apartment List, CME FedWatch

$200B Shopping Spree

Story: Fannie Mae and Freddie Mac have been directed to purchase $200 billion in mortgage-backed securities, aiming to compress the "mortgage spread" and nudge rates lower. The 30-year fixed currently sits at 6.16%, near its lowest level since October 2024. With $9 trillion in agency MBS outstanding, this buy represents just over 2% of the market. The GSEs have already increased their capital by $69 billion as of late 2025, and adding $200 billion more would push them near their $450 billion legal cap. Analysts estimate a potential 0.25 percentage point rate reduction, though some note the spread has already tightened significantly. As one economist quipped: "Much of the juice appears to have been squeezed."

So What? Lower rates could boost buyer demand… Good news if you're selling, trickier if you're buying into more competition. However, here's the catch: any rate dip may push prices higher, thereby offsetting the affordability gains. This is a demand-side play in a supply-side crisis. Without more homes being built, it's treating symptoms, not the disease. For landlords, rental demand stays strong. For flippers, observe those price movements.

What’s Next? Expect quick execution. FHFA says purchases can move fast. Watch MBS spreads for rate movement signals, and keep an eye on broader housing policy announcements expected at Davos later this month. A decision on a potential Fannie/Freddie IPO is scheduled within the next month or two, although analysts believe this MBS push suggests those plans are cooling.

Source: Yahoo! Finance

NEST PICKS

Top Weekly Stories:

1️⃣ Housing: Kenosha, Wisconsin, claimed the hottest housing market crown in December, bumping Springfield, Mass., to second. It turns out that the Midwest's tight inventory and $ 84,000 median prices are catnip for buyers fleeing Chicago's affordability crunch. 🪺 More

2️⃣ Build To Rent: Trump announced plans to ban institutional investors from buying single-family homes, declaring, "people live in homes, not corporations"… Rental REIT stocks promptly face-planted on the news. 🪺 More

3️⃣ Mortgages: The 30-year fixed rate edged up to 6.16%, but that's still the lowest start to a new year since 2022; First-time buyers, your window might be cracking open. 🪺 More

4️⃣ Interesting Trends: The median U.S. monthly housing payment dropped to $2,365, down 4.7% year-over-year, and the lowest since early 2024. But don't expect a buyer stampede until the "holiday hangover" wears off. 🪺 More

5️⃣ Policy Changes: Tennessee is offering complete property tax reimbursements for homeowners 65+ with 20 years of state residency. 🪺 More

INVESTOR HIGHLIGHTS:

📽️ Video Highlight: These Rental Properties Will ALWAYS Lose You Money $$$ (NEVER BUY!!!)

📰 Article Highlight: Why Investing in Single-Family Rentals is the Simplest Way to Become a Millionaire

💸 Off-Market Deal: Easy Pine Lawn SFR Flip or Rental - $60,000